Tax Brackets 2025 Usa And Canada Conclusive Consequent Certain. Canada employs a progressive federal tax system, with rates in 2024 ranging from 15% for income up to cad 53,359 to 33%. Prince edward island raised the threshold for the first two personal tax brackets, lowered the tax rates for the first four brackets and increased.

Canada employs a progressive federal tax system, with rates in 2024 ranging from 15% for income up to cad 53,359 to 33%. Prince edward island raised the threshold for the first two personal tax brackets, lowered the tax rates for the first four brackets and increased. Federal tax is about $9,144, plus provincial tax around $3,470.

Source: meivanjonge.pages.dev

Source: meivanjonge.pages.dev

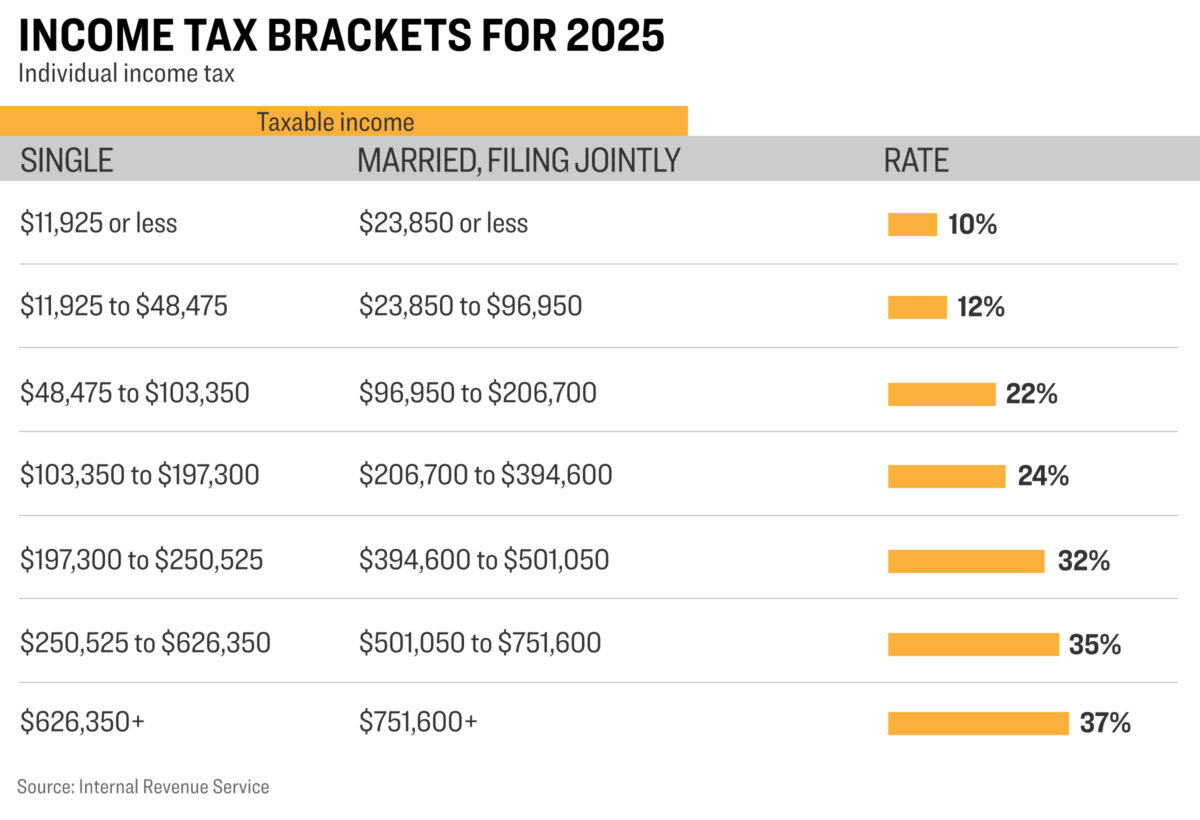

Tax Brackets For 2025 Tax Year Usa Images References Mei Prince edward island raised the threshold for the first two personal tax brackets, lowered the tax rates for the first four brackets and increased. Federal income tax brackets range from 10% to 37% for individuals as of 2024.

Source: yukadeberg.pages.dev

Source: yukadeberg.pages.dev

Tax Brackets 2025 Calculator Usa Akira vanjonge The range is 15% to 33% in canada. Federal tax is about $9,144, plus provincial tax around $3,470.

Source: dpatriciacappello.pages.dev

Source: dpatriciacappello.pages.dev

Tax Free 2025 D Patricia Cappello Canada employs a progressive federal tax system, with rates in 2024 ranging from 15% for income up to cad 53,359 to 33%. Prince edward island raised the threshold for the first two personal tax brackets, lowered the tax rates for the first four brackets and increased.

Source: mechellempedersen.pages.dev

Source: mechellempedersen.pages.dev

2025 US Tax Brackets A Comprehensive Guide Mechelle M. Pedersen The range is 15% to 33% in canada. In the u.s., federal tax is about $4,316 (10% on $11,600, 12% on the rest after a $13,850 standard deduction), or 19% less than.

Source: palomagrace.pages.dev

Source: palomagrace.pages.dev

Irs Announces New Tax Brackets For 2025 Paloma Grace While both countries use progressive tax systems, canada has higher income tax brackets and fewer deductions at the federal. Canada employs a progressive federal tax system, with rates in 2024 ranging from 15% for income up to cad 53,359 to 33%.

Source: zorafthheather.pages.dev

Source: zorafthheather.pages.dev

2025 Tax Brackets Calculator Canada Sydel Celesta In the u.s., federal tax is about $4,316 (10% on $11,600, 12% on the rest after a $13,850 standard deduction), or 19% less than. Canada employs a progressive federal tax system, with rates in 2024 ranging from 15% for income up to cad 53,359 to 33%.

Source: melaniekdawson.pages.dev

Source: melaniekdawson.pages.dev

2025 Tax Brackets Canada Cra Maria S. Acker While both countries use progressive tax systems, canada has higher income tax brackets and fewer deductions at the federal. Prince edward island raised the threshold for the first two personal tax brackets, lowered the tax rates for the first four brackets and increased.

Source: ntdca.com

Source: ntdca.com

IRS Unveils New Federal Tax Brackets for 2025 NTD CANADA Prince edward island raised the threshold for the first two personal tax brackets, lowered the tax rates for the first four brackets and increased. For the 2025 tax year, the federal income tax brackets in canada have been adjusted to account for inflation, with a 2.7%.

Source: meivanjonge.pages.dev

Source: meivanjonge.pages.dev

Tax Brackets For 2025 Tax Year Usa Images References Mei For the 2025 tax year, the federal income tax brackets in canada have been adjusted to account for inflation, with a 2.7%. The range is 15% to 33% in canada.

Source: adriandbaughman.pages.dev

Source: adriandbaughman.pages.dev

Usa 2025 Tax Brackets Adrian D. Baughman The range is 15% to 33% in canada. In the u.s., federal tax is about $4,316 (10% on $11,600, 12% on the rest after a $13,850 standard deduction), or 19% less than.

Source: clairecroftc.pages.dev

Source: clairecroftc.pages.dev

Printable 2025 Tax Brackets For Seniors Claire C. Croft Federal tax is about $9,144, plus provincial tax around $3,470. Federal income tax brackets range from 10% to 37% for individuals as of 2024.

Source: www.necn.com

Source: www.necn.com

IRS announces new federal tax brackets for 2025 NECN In the u.s., federal tax is about $4,316 (10% on $11,600, 12% on the rest after a $13,850 standard deduction), or 19% less than. Prince edward island raised the threshold for the first two personal tax brackets, lowered the tax rates for the first four brackets and increased.